30+ Debt to income ratio for house

Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Apply Now With Quicken Loans.

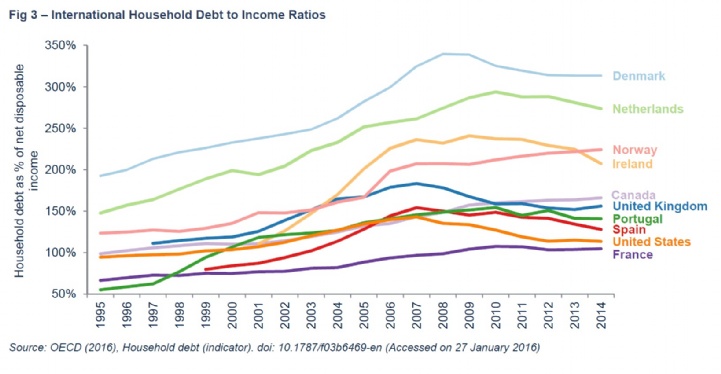

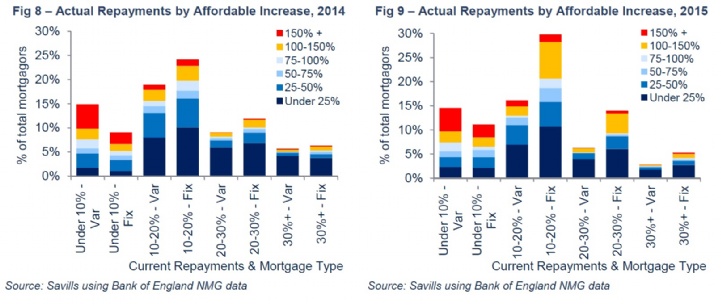

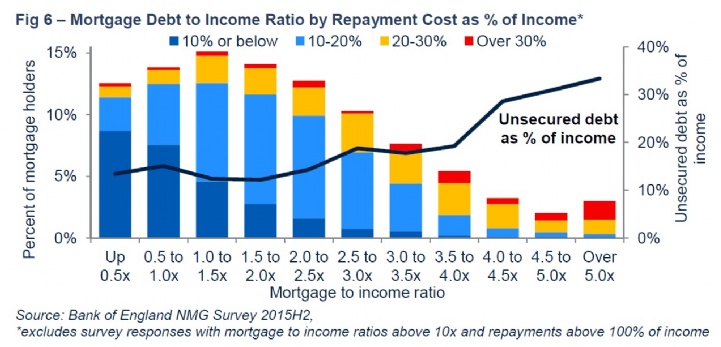

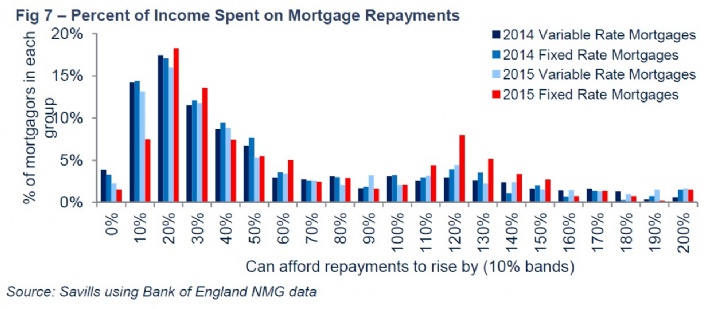

Savills Household Debt

Lock Your Mortgage Rate Today.

. Compare Mortgage Options Calculate Payments. A high debt-to-income ratio can be an indication of financial trouble ahead even if you seem to be easily managing your payments right now. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on.

Generally a debt-to-income ratio of 36 or less but no higher than 43 is within the average. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing. Ad Were Americas Largest Mortgage Lender.

Ad Looking to Lower Your Debt. It states that a household should spend no more than 28 of its gross monthly income on the. This is a total monthly debt amount of 1550 per month.

12 For example assume your gross. Remember the DTI ratio calculated here reflects your situation before any new borrowing. Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI.

Trusted VA Loan Lender of 300000 Veterans Nationwide. You will pay off the loan earlier with a 15-year term and will have a. In the United States lenders use DTI to qualify home-buyers.

Add up your monthly debts and divide them by your monthly income before taxes. Compare Mortgage Options Calculate Payments. The Bureau also explained gross monthly income as the amount of money that a person earns before his taxes and other relevant deductions are subtracted from said income.

For example lets say your debt-to. If you apply for a conventional home loan your ideal DTI ratio should be 36 or less. Heres how to figure out your debt-to-income ratio.

Apply Now With Quicken Loans. As a quick example if. A Mortgage Refinance Could Reduce Your Monthly Payments.

Consolidate Debt with a Cash Out Refinance. Be sure to consider the impact a new payment will have on your DTI ratio and. Lower your debt-to-income ratio.

Some homebuyers may opt for a 15-year or 30-year fixed home mortgage. Lenders typically view DTI according to the following guidelines. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Lenders prefer a back-end DTI ratio lower than 36 and no more than 28 for. The debt-to-income ratio will be displayed as a percentage.

Lock Your Mortgage Rate Today. Find Out If You Qualify Today. Income limits for direct-issue loans are much loweras low as 50 of the median income in certain areas.

Ad Were Americas Largest Mortgage Lender. Your debt-to-income ratio is 1550 divided by 5000. Debt-to-income DTI Ratio To qualify for a USDA loan your total debt.

A good debt-to-income ratio to buy a house depends on your mortgage program. Lets also assume you have a gross monthly income of 5000. On the other hand if youre.

What Should Your Total Debt To Income Ratio Be Quora

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

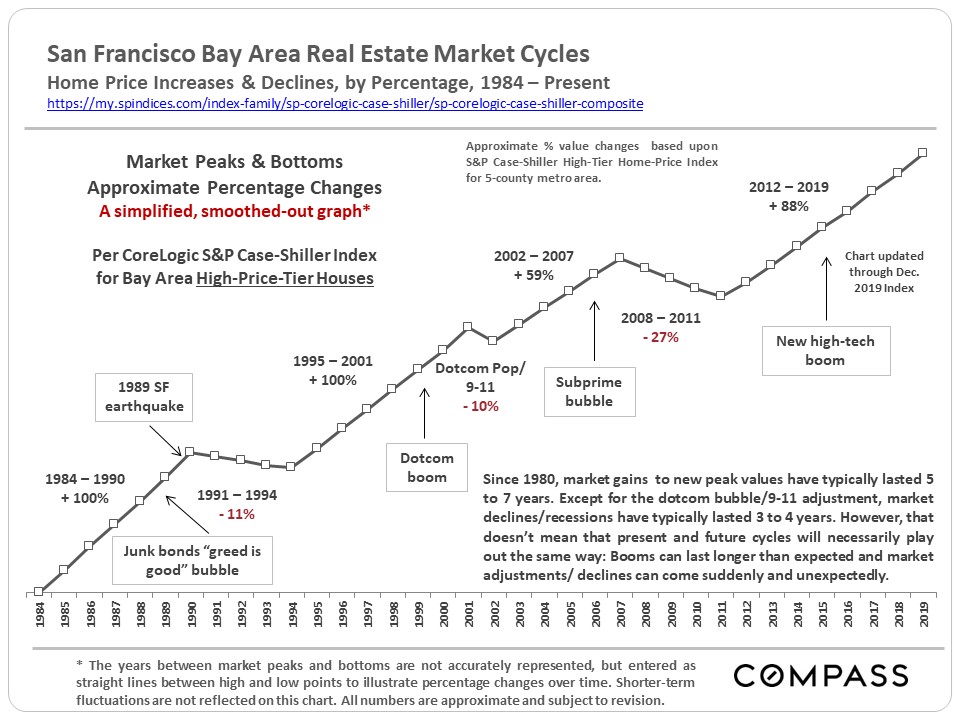

30 Years Of Bay Area Real Estate Cycles Compass Compass

What Should Your Total Debt To Income Ratio Be Quora

Savills Household Debt

America S Total Debt Report Page 2 By Mwhodges

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

.jpg)

Savills Household Debt

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Savills Household Debt

Pin On Life After College

If Someone Took The Us Debt To Income Ratio And Made A Percentage Comparison To A Household Budget Of 80 000 What Would The Numbers Be Quora

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

Sinking Funds Worksheets With 2 Free Printables Sinking Funds Printable Budget Worksheet Budgeting Worksheets